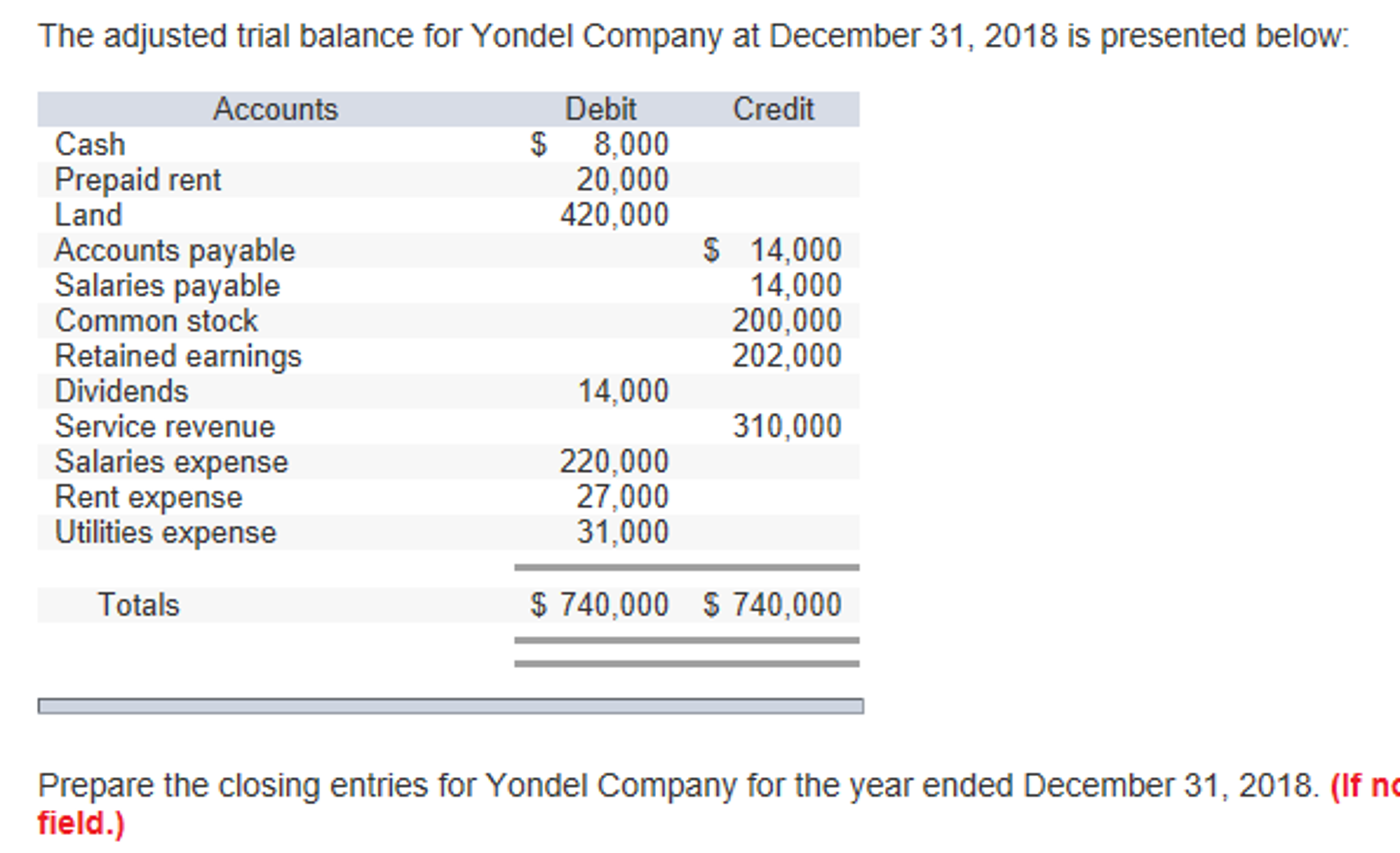

By doing so companies move the temporary account. Enter the day and month when the company closes the dividend account for the period. Debit Net income for 1022 million 08. The closing process reduces revenue expense and dividends account balances temporary accounts to zero so they are ready to receive data for the next accounting period. Closing entries are manual journal entries at the end of an accounting cycle to close out all the temporary accounts and shift their balances to permanent accounts. The closing entries are the journal entry form of the Statement of Retained Earnings. Closing entries are journal entries created at the end of an accounting period to transfer your temporary account balances into one permanent account. The credit entry to dividends payable represents a balance sheet liability. Note that by doing this it is already deducted from Retained Earnings a capital account hence will not require a closing entry. Companies use closing entries to reset the balances of temporary accounts accounts that show balances over a single accounting period to zero.

The credit entry to dividends payable represents a balance sheet liability. Write the date when the closing entry is recorded in the general journal. The fourth entry requires Dividends to close to the Retained Earnings account. The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. The Accounting Cycle And Closing Process. By doing so companies move the temporary account. Hence the value of stock dividend is 250000 500000 x 10 x 5. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Business Accounting Closing entries The entry to close dividends would include a debit to. On January 15 2020 the company can make dividend paid journal entry as below This journal entry is to eliminate the dividend liabilities that the company has recorded on December 20 2019 which is the declaration date of the dividend.

Note that by doing this it is already deducted from Retained Earnings a capital account hence will not require a closing entry. In this journal entry as the company issues the small stock dividend less than 20-25 the market price of 5 per share is used to assign the value to the dividend. On January 15 2020 the company can make dividend paid journal entry as below This journal entry is to eliminate the dividend liabilities that the company has recorded on December 20 2019 which is the declaration date of the dividend. Hence the value of stock dividend is 250000 500000 x 10 x 5. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. Instead declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the companyin this case its shareholders. The fourth entry requires Dividends to close to the Retained Earnings account. These journal entries condense your accounts so you can determine your retained earnings or the amount your business has after paying expenses and dividends. The closing entry for dividends would include which of the following.

The balance on the dividends account is transferred to the retained earnings it is a distribution of retained earnings to the shareholders not an expense. The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. Instead declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the companyin this case its shareholders. Credit Cash for 1022 million b. When the company ABC declares the stock dividend on December 18 2020 it can make the journal entry as below. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Accountants may perform the closing process monthly or annually. Dividends Declared Journal Entry Bookkeeping Explained. The fourth entry requires Dividends to close to the Retained Earnings account.

The closing process reduces revenue expense and dividends account balances temporary accounts to zero so they are ready to receive data for the next accounting period. When dividends are declared by corporations they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. The fourth entry requires Dividends to close to the Retained Earnings account. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. Note that by doing this it is already deducted from Retained Earnings a capital account hence will not require a closing entry. Closing the dividend account makes it easier for a company to track changes in dividends paid to shareholders from year to year as explained by the Cliffs Notes website. By doing so companies move the temporary account. On January 15 2020 the company can make dividend paid journal entry as below This journal entry is to eliminate the dividend liabilities that the company has recorded on December 20 2019 which is the declaration date of the dividend. The process is done so that you can determine how much retained earnings or owners equity you own after expenses andor dividends have been subtracted. A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account.