View all DB assets cash debt liabilities shareholder equity and investments. Add the earning assets from the current year and previous year and divide the answer by 2. Earning assets are the assets that earn and generate income for the owner just in the same way as done by interest or dividend. The table below ties together information from Bank of Americas balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on. Therefore part of a banks ASSETS is the money it loans but this is not their money. Add the earning assets from the current year and previous year and divide the answer by 2. Earning assets include stocks bonds income from rental property certificates of deposit CDs and other interest or dividend earning accounts or instruments. Like any other company a banks balance sheet consists of three parts. Are Retained Earnings an Asset. Apple Inc which makes consumer electronics computers and other products had retained earnings of 459 billion as of September 28 2019.

The earning assets to total assets ratio is a formula that banks commonly use to evaluate the proportion of a companys assets that are actively generating income. This is the average earning assets. Instead the corporation likely used the cash to acquire additional assets in. Earning assets are the assets that earn and generate income for the owner just in the same way as done by interest or dividend. Bank Balance Sheet Other Earning Assets Relate Posts. Deutsche Bank AG Annual balance sheet by MarketWatch. They can provide a steady income. Bank Balance Sheet Loans. Bank Balance Sheet Metrics. Similarly you may ask what do you mean by earning assets.

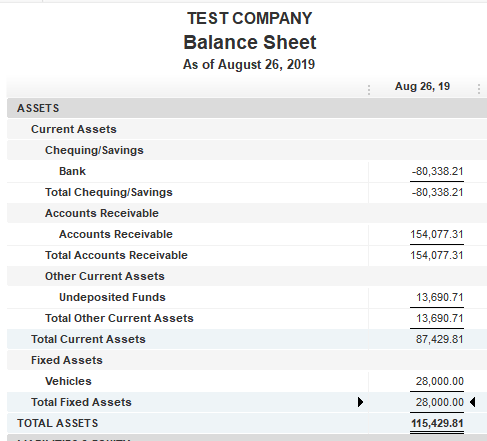

Other Earning Assets Total. Click to see full answer. Assets Liabilities and Bank Capital. Bank Balance Sheet Other Earning Assets. A banks balance sheet is different from that of a typical company. Cash Due from Banks. A balance sheet aka statement of condition statement of financial position is a financial report that shows the value of a companys assets liabilities and owners equity on a specific date usually at the end of an accounting period such as a quarter or a year. Add the earning assets from the current year and previous year and divide the answer by 2. Retained earnings show up on a companys balance sheet. The table below ties together information from Bank of Americas balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on.

But banks do not operate like regular companies do. Bank Balance Sheet Other Earning Assets. Bank Balance Sheet Other Earning Assets Relate Posts. Liabilities on a banks balance sheet Net worth is the shareholders capital in the bank. You wont find inventory accounts receivable or accounts payable. Similarly you may ask what do you mean by earning assets. Are Retained Earnings an Asset. Bank Balance Sheet Loans. Use the balance sheets from the current year and previous year to find the average earnings assets and the average total assets. Cash Due from Banks.

A balance sheet aka statement of condition statement of financial position is a financial report that shows the value of a companys assets liabilities and owners equity on a specific date usually at the end of an accounting period such as a quarter or a year. Bank Balance Sheet Other Earning Assets. While the amount of a corporations retained earnings is reported in the stockholders equity section of the balance sheet the cash that was generated from those retained earnings is not likely be in the companys checking account. The earning assets to total assets ratio is a formula that banks commonly use to evaluate the proportion of a companys assets that are actively generating income. Instead under assets youll see mostly loans and. Bank Balance Sheet Other Earning Assets Relate Posts. Earning assets are the assets that earn and generate income for the owner just in the same way as done by interest or dividend. View all DB assets cash debt liabilities shareholder equity and investments. You wont find inventory accounts receivable or accounts payable. Are Retained Earnings an Asset.