IAS 77 then notes that cash equivalents are held for the purpose of meeting short term cash commitments rather than for investment or other purposes. Objective of IAS 7 Statement of Cash Flows. Financing activities are those activities which relate to changes in the size and composition of the contributed equity and borrowings of the entity. IAS 7 Statement of Cash Flows applied on the statements after 1 January 1994. Disclosure of changes in liabilities arising from financing activities 44. CIMA F1 IAS 7 Investing activitiesFree lectures for the CIMA F1 Financial Reporting and Taxation ExamsCIMA Operational Level. Investing activities 16 The separate disclosure of cash flows arising from investing activities is important because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows. Section A IAS 7 or related IFRS reference Key definitions IAS 76 Classification and presentation of cash flows as operating investing or financing activities IAS 711-20 Special topics IAS 725-42B Non-cash transactions IAS 743-44 Disclosures IAS 745-52 Requirements Defines the following. So what are financing activities. This information shall be provided in the statement of cash flows which classifies cash flows during the period from operating investing and financing activities.

Investing activities 16 The separate disclosure of cash flows arising from investing activities is important because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows. Classification of interest and dividends. The activities which are undertaken by the entity for the purchase of long term assets and investments which are not the part of cash equivalents including the disposal of such long term assets and investments are. This information shall be provided in the statement of cash flows which classifies cash flows during the period from operating investing and financing activities. Entities disclose such items as either operating investing or financing activities consistently from period to period. A Cash flow from operating activities b Cash flow from investing activities or financing activities. IAS 7 Statement of Cash Flows applied on the statements after 1 January 1994. Disclosure of changes in liabilities arising from financing activities 44. Cash is cash on hand and demand deposits. Objective of IAS 7 The objective of IAS 7 Statement of cash flows is to require the information about the historical changes in cash and cash equivalents of an entity.

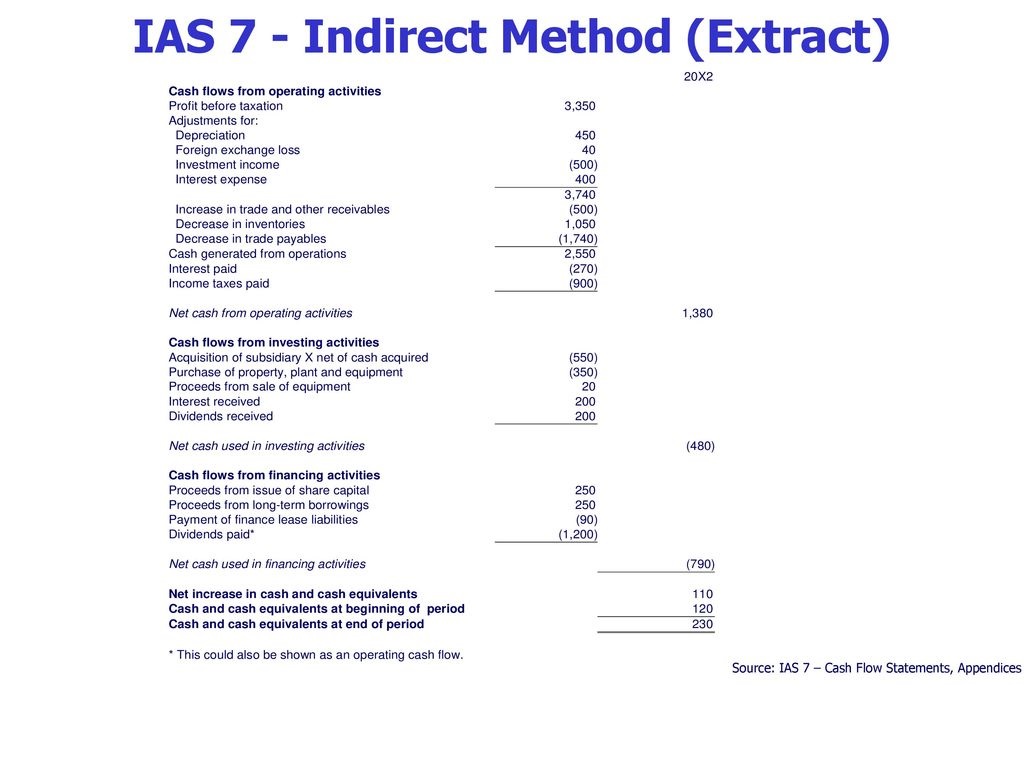

Statement of Cash Flows. IFRS Explanations Statement of cash flows. Activities since they relate to the main revenue-producing activity of that entity. Section A IAS 7 or related IFRS reference Key definitions IAS 76 Classification and presentation of cash flows as operating investing or financing activities IAS 711-20 Special topics IAS 725-42B Non-cash transactions IAS 743-44 Disclosures IAS 745-52 Requirements Defines the following. The staff had also raised an additional issue relating to IAS 716 which states that only expenditures that result in a recognised asset in the statement of financial position are eligible for classification as investing activities. CIMA F1 IAS 7 Investing activitiesFree lectures for the CIMA F1 Financial Reporting and Taxation ExamsCIMA Operational Level. Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to insignificant risk of changes in value. The third section of a statement of cash flows is for financing activities. Definition of cash and cash equivalents. Disclosure of changes in liabilities arising from financing activities 44.

Statement of Cash Flows. Investing activities 16 The separate disclosure of cash flows arising from investing activities is important because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows. As a result of the changes in terminology used throughout the IFRS Standards arising. So what are financing activities. Investments normally only qualify as cash equivalent if they have. IAS 77 then notes that cash equivalents are held for the purpose of meeting short term cash commitments rather than for investment or other purposes. Definition of cash and cash equivalents. Entities disclose such items as either operating investing or financing activities consistently from period to period. IAS 7 requires an entity to present the information about changes in the cash and cash equivalents by a. Objective of IAS 7 The objective of IAS 7 Statement of cash flows is to require the information about the historical changes in cash and cash equivalents of an entity.

So what are financing activities. IAS 7 requires an entity to present the information about changes in the cash and cash equivalents by a. Definition of cash and cash equivalents. Financing activities are those activities which relate to changes in the size and composition of the contributed equity and borrowings of the entity. Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to insignificant risk of changes in value. Investments normally only qualify as cash equivalent if they have. IFRS Explanations Statement of cash flows. The activities which are undertaken by the entity for the purchase of long term assets and investments which are not the part of cash equivalents including the disposal of such long term assets and investments are. IAS 7 Presentation of a statement of cash flows 10 The statement of cash flows shall report cash flows during the period classified by operating investing and financing activities. As a result of the changes in terminology used throughout the IFRS Standards arising.